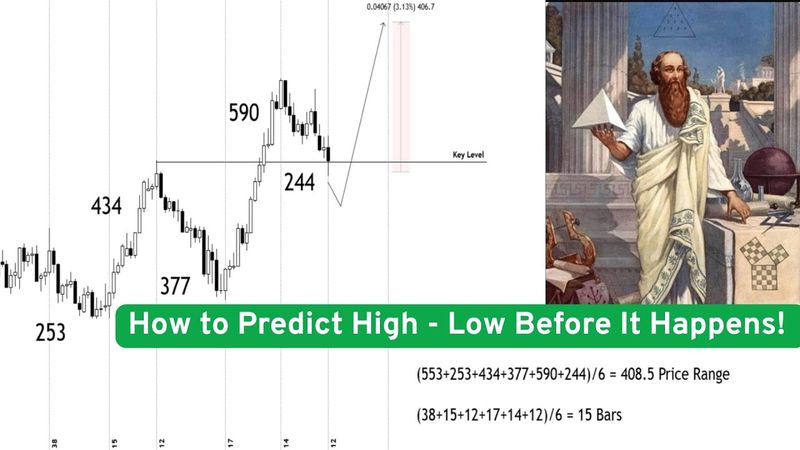

How to Predict Market Highs & Lows with Gann Time & Price Theory | Gann Sacred Geometry.

How to Predict Market Highs & Lows with Gann Time & Price Theory | Gann Sacred Geometry. Videosu İçin İndirme Bilgileri ve Detaylar

Yükleyen:

GannAstroTrader | Decoding Gann Trading SecretsYayınlanma Tarihi:

21.02.2025Görüntülenme:

18.2KAçıklama:

Benzer Videolar: How to Predict Market Highs

The Silver & Gold Data Nobody Wants To Show You | Mike Maloney & Alan Hibbard

Capricorn Everything Aligns Today Your Soul Receives Its Gift! 🩵 January Monthly Tarot

Stock Market Fraud: What Is Jane Street, How It Earned ₹36,500 Cr? Ankit Agrawal Study IQ

WILDLIFE DOLBY VISION™ COMPILATION - 8K ULTRA HD HDR 60 FPS

Rethinking Death: Exploring What Happens When We Die