Private Equity is a TERRIBLE Investment... Who Keeps Giving Them Money?

Download information and video details for Private Equity is a TERRIBLE Investment... Who Keeps Giving Them Money?

Uploader:

How Money WorksPublished at:

6/30/2025Views:

512.7KDescription:

Looking to grow your business online? Odoo is an all-in-one solution for businesses. Get started today with a 14-day trial → ----- Sign up for our FREE newsletter! - Books we recommend - Listen on Spotify - ----- My Other Channel: @HowMoneyWorksUncut @HowHistoryWorks Edited By: Svibe Multimedia Studio Music Courtesy of: Epidemic Sound Select Footage Courtesy of: Getty Images 📩 Business Inquiries ➡️ [email protected] Sign up for our newsletter 👈 All materials in these videos are for educational purposes only and fall within the guidelines of fair use. No copyright infringement intended. This video does not provide investment or financial advice of any kind. #privateequity #finance #money ----- 20 years ago if you asked the average person what they thought about private equity they would probably have no idea what you were talking about. The business was a small, un-glamourous, and overlooked side of finance that people went into if they couldn’t land a job in a hedge fund where the real money was made. Since then though, changes in regulations, investor preferences, and the availability of cash has allowed the industry to grow to over TWENTY TIMES its size back in 2000. In that time it minted dozens of billionaires, acquired millions of businesses, developed a bad reputation, and simply grown too big for its own good. The thing that originally MADE private equity a competitive investment WAS its small size and understated operations. But (not unlike a parasite that has outgrown its host) the biggest threat to private equity today… is private equity. Deals are getting harder to find, fees are getting harder to justify and returns are simply not worth the risk. Now I know that you might think that sounds like a problem for wealthy investors and asset managers, not you… but the whole system ONLY works by borrowing A LOT of money through business structures that look like this and assuming that things will keep growing forever. If that doesn’t happen, there are now TRILLIONS of dollars in loans that could go bad, and I am sorry to be the one to tell you… but that IS going to be a problem for you. So if Private Equity has become such a bad investment… who keeps on giving them money?

Video Transcription

20 years ago, if you asked the average person what they thought about private equity, they would probably have no idea what you were talking about.

The business was a small, unglamorous, and overlooked side of finance that people went into if they couldn't land a job at a hedge fund where the real money was made.

Since then, though, changes in regulations, investor preferences, and the availability of cash has allowed the industry to grow to over 20 times its size back in 2000.

In that time, it meant dozens of billionaires acquired millions of businesses, developed a bad reputation, and simply grown too big for its own good.

The thing that originally made private equity a competitive investment was its small size and understated operations.

But not unlike a parasite that has outgrown its host, the biggest threat to private equity today is private equity.

Deals are getting harder to find, fees are getting harder to justify, and returns are simply not worth the risk.

Now, I know that you might think this sounds like a problem for wealthy investors and asset managers, not you.

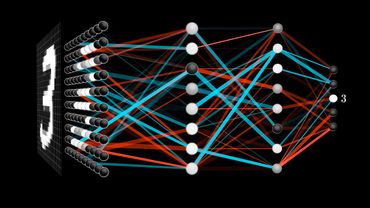

But the whole system only works by borrowing a lot of money through business structures that look like this and assuming that things will keep growing forever.

If that doesn't happen, there are now trillions of dollars in loans that could go bad.

And I'm sorry to be the one to tell you, but that is going to be a problem for you.

So if private equity has become such a bad investment, who keeps on giving them money?

what do you do out here in new york city i'm in finance like what exactly uh private equity what is the most amount of money you made in a single year half a million half a million yeah companies that are owned by private equity firms are significantly more likely to go bankrupt the endless shrimp is not the reason red's lobster is in bankruptcy the fundamental problem is the red lobster got involved in what's called private equity

You can't keep doing that.

You know why?

Because the ratio of the debt of the United States has become unsustainable.

Okay, so a quick refresher on what private equity is and how it actually works.

Private equity simply means any investment made into businesses or assets that are not listed on public securities markets.

Technically, if you invest a few thousand dollars into a local cafe, you are a private equity investor.

Now, what actually brings all the boys in sleeveless vests to the yard are dedicated private equity funds that raise money from a pool of high-profile investors and use that to buy entire businesses, the so-called buyout funds.

These kinds of private equity firms will take their investors money, put in a little bit of their own, and then borrow as much as they can to fill up a pool of capital that they can then use to make acquisitions.

Once they buy up a portfolio of real companies producing real products and generating real cash flows, they get those businesses to take out big loans to pay money back to them through a special dividend.

This means that the founding partners of these firms can own billions of dollars worth of assets while only having invested a tiny fraction of their own money.

But it doesn't stop there.

The private equity company isn't actually responsible for any of the loans that its portfolio companies take out that begins and ends with the companies themselves.

It's like if you own shares in Walmart, you aren't responsible for the company's loans if they fail to repay them.

The most you can lose is the money you invested if your shares go to zero.

In the case of private equity, what this lets them do is go back to a bank and show them a big portfolio of private businesses which they can use as security to get you yet another loan.

These are called net asset value loans, but since they are loans taken out against companies that already have loans, they are normally just called leverage on leverage or leverage squared, which does sound familiar.

Anyway, the debt doesn't stop there.

Remember that money that the wealthy investors and private equity partners put in to get the whole firm started in the first place?

Well, normally even that money is borrowed because investment loans are a very tax efficient way for wealthy investors to gain exposure to these firms.

But it gets worse.

One of the downsides of private equity is that, by definition, it's private, as in not listed on public markets.

That means it can be difficult for investors to turn their holdings in the firm into cash when they need the money.

Fortunately for them, there are firms that will buy stakes in private equity firms from investors called secondaries funds.

Now, regulations actually prevent these secondary funds from using debt to fund their acquisitions.

except of course that's not true at all most of their purchases are indeed also financed with debt so if you are keeping track they will take on debt to buy a stake in a firm originally purchased with debt that was used as a down payment on more debt to buy a business that took on debt to deliver paper returns to a fund which used those returns to qualify for more debt to buy more companies that could be used to take on more debt

But anyway, that's still not everything.

So far, this kind of lending has been really profitable, which is why it's not just banks getting in on the action.

Some private equity firms have specialized in just lending money to private companies and other private equity firms rather than acquiring the companies themselves.

Now that sly bastard Dan Toomey beat me to it again, but these private credit firms have exploded in scope and scale over the last decade and they now have over $1.6 trillion in lending within the USA alone according to data from Prequin, a financial research firm.

The exact scale of this lending is hard to know exactly, because since these private credit firms are not officially banks and they are lending to private companies with no public reporting obligations it can be very hard to get reliable data.

Now, you're never going to be able to guess where these private credit firms get their money to do this lending.

yeah that's right they borrow it this endless cycle of leverage on leverage on leverage is why private equity has been able to scale so rapidly and generate so much money for the people working in all of these different organizations but this money still had to come from somewhere and statistically it's come from you so it's time to learn how many works to find out what happens when all of this debt unravels the other way this video is sponsored by odoo odoo is a complete business management platform that brings together everything

Sales, CRM, inventory, accounting, and yes, even a powerful website builder, all in one seamless system.

With Odoo's website builder, you can launch a clean, professional-looking site in just a few clicks.

It's totally free with unlimited hosting, support, and they even throw in a custom domain for a year.

Last month we announced we've transitioned our How Money Works library completely over to Odoo, giving it a fresh new home and making it easier how we bring our book recommendations to you.

And here's the exciting part, we're already working on yet another project with Odoo that we can't wait to reveal.

What I love is how simple the whole process is,

Just drag, drop, customize, and go.

Plus, if you're stuck on copy, Odoo has built-in chat GPT tools to help you shape the perfect message in seconds.

If you want to simplify your setup or build something from scratch, give Odoo a try.

Hit the link in the description to test out any app for free.

No credit card needed.

It's now one of the widely accepted rules of investing that it's almost impossible to beat the returns of the market long term.

There are once-in-a-generation exceptions to this like Warren Buffett and Jim Simons, but they practically created totally new ways of investing from scratch.

Endless, backdated research has effectively found the same thing.

Any investment managers that have outperformed the market in the past have done so almost entirely because they got lucky.

Funds that get lucky generally outperform in the future and tend to underperform over the following years.

This trend can actually be worse than straight up gambling because it's a highly efficient way to destroy wealth.

Now, the infamous Cathie Wood generated outstanding returns through her ARK Innovation Fund by basically going all in on one of the biggest hype stocks of all time.

In particular, her outstanding performance in 2020 attracted a lot of investors to buy into the fund, right before it lost 70% of its value and has since delivered weak overall returns.

Since its inception in 2014, the fund has delivered 200% returns, which is only slightly worse than the 226% the S&P returned over the same time period.

But most ARK investors did not buy in back in 2014.

They bought up here at peak hype.

So even though the fund has performed okay overall, most investors are holding huge losses.

On top of this, active investment managers charge fees for the privilege of managing your money, which further puts them statistically behind over the long term compared to a passive, diversified, low-cost index fund.

The fees charged by private equity funds are generally some of the highest in the industry, sometimes charging clients 5 to 10 times more in fees than even regular actively managed funds, which means that in an efficient market they would fall even further behind.

Now, the rich people and institutional investors that give money to private equity managers know this, the research is not new, and it's been widely accepted for decades at this point.

So then, who keeps giving private equity so much money?

Well, hot take alert, but the original idea of private equity was actually really good.

Now, I know a lot of you are furiously typing in the comments already, because yeah, private equity has turned into an incredibly destructive monolith, but it didn't start out like this.

For investors, it actually could beat the market because it had nothing to do with the market.

Private equity didn't deal with listed companies, so it didn't have to compete with all the nerds on Wall Street that did mathematics PhDs at Penn to eke out three basis points of alpha.

Instead of trying to find hidden value in terabytes of market data, private equity instead invested in smaller local businesses and actively added value by combining their business acumen with the skills of the previous owners.

A lot of small business owners are really good at their craft, but they lack formal business training so they don't optimize things like marketing, accounting, tax management, or expansion opportunities.

In theory, the management teams from private equity could find these businesses, make their improvements, and maximize the returns of good, honest businesses to beat the market consistently.

In the early days, this was not a job that finance bros wanted to be doing because instead of hanging out in Manhattan high-rises working on glamorous deals, they would be setting up bookkeeping software for a regional plumbing company in Ohio.

Over time, people noticed that they could make a lot of money and charge a lot of fees for this kind of groundwork, which made it more attractive than even top investment banks or hedge funds.

But this has started to change for three reasons.

The first problem is that as the popularity of private equity has grown, it's become harder to find businesses worth buying.

Back in the early days, when the industry was still in its infancy, small business owners would find it really difficult to sell their businesses because not many people have the capital and the expertise to run something like an HVAC company or mechanic shop.

Because of this, private equity firms could normally acquire a business for just two to three times their annual earnings, meaning even if they didn't make any improvements, they would theoretically be making strong returns just for maintaining operations.

But as more firms got into the game, the people selling their businesses had more offers coming in, which meant new PE firms had to make bigger and bigger bids to secure acquisitions.

According to First Page Sage, a research firm that collects data on this industry, the average HVAC company now sells for a multiple of between five and 10 times their earnings.

Now, this data is really hard to collect, because the details of private equity business sales don't need to be publicly disclosed.

This particular report is just a guesstimation based on network feedback, expert interviews, and internal databases.

Even based on these rough numbers, a business that pays 10 years to cover its purchase price is no longer beating the market after fees and expenses, which means that private equity firms had to start pushing their portfolio companies harder to squeeze out more profit and then flip them for big capital gains.

Now, for a while, this worked because of a fun little trick that they could pull in a growing market.

After private equity firms improved the businesses they acquired, they could sell it for a profit.

And over time, the largest buyer of businesses sold by private equity firms were other private equity firms.

As new firms were paying more and more for acquisitions every year, this made returns look incredibly strong because they were literally pumping their own market.

These strong returns attracted more investment and allowed private equity companies to take on more debt to buy more businesses driving up prices, which created strong returns for the people who got in early.

This little feedback loop generated incredible returns and made the long-term risks someone else's problem, so it incentivized the second problem.

once firms ran out of good stable businesses with solid cash flows to acquire they had to look for riskier options to pull the same trick with that either meant paying more for businesses in good stable industries or looking at questionable businesses in risky industries it didn't really matter because the point was to flip them to the next buyer as a random example there is a good chance that some of your favorite youtube channels are now owned by private equity firms

Look, YouTube channels can be great businesses, but they are just inherently riskier than something like an established carpentry company that has been operating for three generations.

The race to find more businesses means that risks like these will become more common.

The other problem with feedback loops is what happens when they start to go in the other direction.

Over the last two decades, the conditions have been perfect for private equity to grow.

interest rates have been low, there were lots of businesses to acquire, and people wanted an alternative to real estate in the stock market.

But that's changing.

Baby boomers are aging out of their businesses in record numbers, which is putting more supply back onto the market.

Small business owners are also more savvy than they were 20 years ago.

Everything you would ever need to know about running a business effectively is available online, which means there isn't as much opportunity for the private equity Wharton grads to step in and make big improvements.

And finally, people are just becoming more skeptical of the industry.

New investments into private equity have plunged 35% this year, because people are realizing how hard it is to get their cash back out of the system.

2025 is on track to be the lowest fundraising year for private equity in over a decade.

Unlike public stocks, it's really hard to tell how much private companies are actually worth until they are sold.

What this has done is let private equity managers sell the businesses that have performed well and hold onto the businesses that have not.

This makes fund performance look really good by realizing potential gains and hiding unrealized losses.

But it also means that slowly the portfolio fills up with bad underperforming businesses, and that can only be kept under wraps for so long.

If enough investors stop investing, then private equity will lose their biggest buyers, which are other private equity firms.

Another group that has been doing well are the secondaries firms.

These were the firms that would buy stakes of private equity investors for a discount to give them liquidity when they needed it.

In a surprising twist, some of the biggest groups getting out of private equity right now are colleges with large endowments.

Harvard in particular has billions of dollars invested in private equity, and for some reason it needs to raise a little bit of cash right now.

So it's selling its stake to anybody that will buy it.

If new investors can buy discounted shares in buyout firms from panic sellers, then there isn't really any reason why they would invest in a new fund without a discount.

Now, that actually shouldn't be a problem.

The firms could just focus on improving the businesses in their portfolio and accept slightly lower returns for a little while.

The only problem is that great big web of debt from earlier.

A lot of private equity firms need to keep flipping through businesses to maintain repayments to various lenders, and if nobody is buying, that can turn into a very big problem very quickly.

now if there is any good news it's that there is one niche of private credit that is doing very well distressed debt strategies have had their best year ever with over 21 billion dollars raised for funds looking to make emergency loans to businesses going through bankruptcy so you know that's a good sign the bad news is that if this whole system falls apart then trillions of dollars of bad loans are going to impact main street banks pension funds and regular people a lot of this debt was securitized and turned into tranche bonds which were then sold openly with various risk ratings

By layering the debt, private credit firms could offer low-risk, low-return bonds and high-risk, high-return bonds all from the same source of debt.

By design, wealthy investors and the fund managers use a lot of debt because it means they don't actually have to invest that much of their own money to make big returns when things are doing well.

But it also means that they don't stand to lose much if things fall apart either.

Now, fortunately, this is not as big of a structural issue as mortgage-backed securities were in 2008.

But if a PE slowdown can't be managed carefully, it could massively disrupt the market for small businesses, just like the subprime mortgage crisis disrupted the market for real estate.

But wait, there's more.

This has all just been the finance side problems with private equity.

Unfortunately, it gets much worse than that.

Go and watch this video next for a comprehensive rundown of the other problems this industry has caused by growing so quickly in recklessly.

And don't forget to like and subscribe to keep on learning how money works.

Similar videos: Private Equity is a TERRIBLE Investment

Why You Don't Matter Anymore ........... (Economically Speaking)

How Short Term Thinking Won

Online Piracy's Great Comeback

The 1-Person Business That Thrives in a Bad Economy

If AI Takes All Of Our Jobs... Who's Going To Buy Everything?